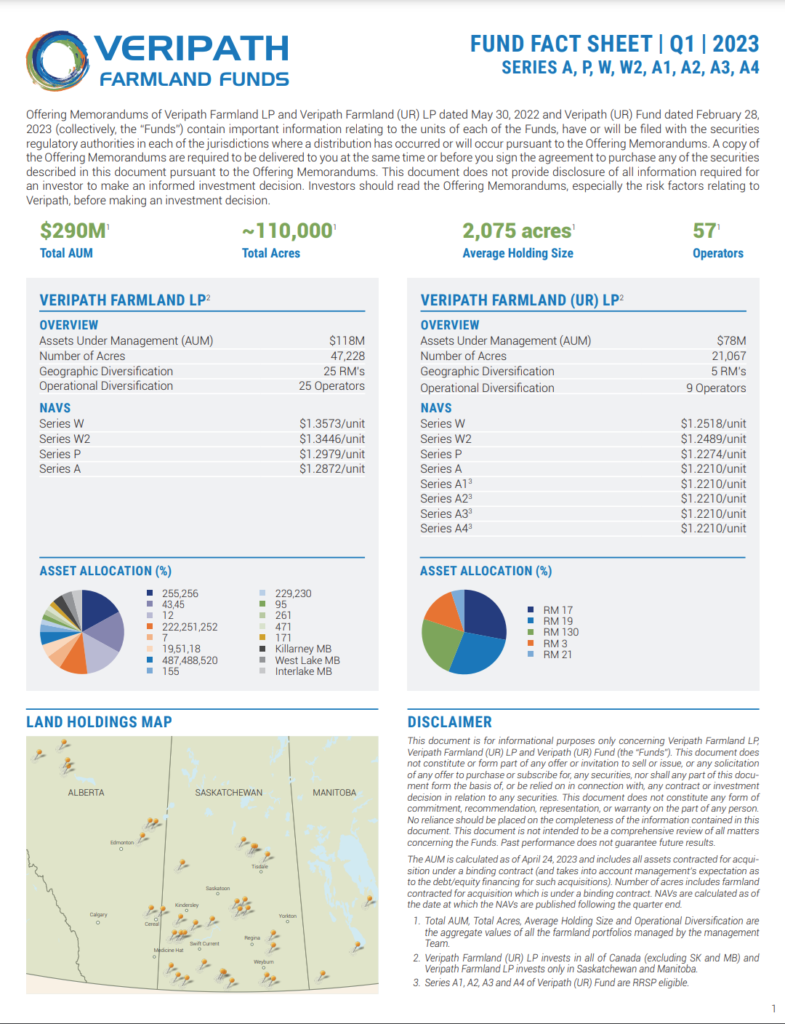

About Veripath

Veripath Partners manages a portfolio of row-crop land, diversified across geographies and operators. Veripath’s investment team has a 15+ year track record in the farmland investment space.

Investment Thesis

The Veripath team seeks to provide superior absolute and risk adjusted returns linked to farmland price disparities and overall agriculture commodity demand. Farmland has demonstrated compelling financial characteristics which drew members of the Veripath team to the asset class as early as 2007 – low volatility, consistent nominal rates of returns, and low correlation to many traditional investments.

Open-ended Approach

Veripath uses an open-ended structure which gives investors control over how long they want to deploy capital and after the contracted hold period they can simply redeem at the prevailing NAV at a time of their choosing.

Sustainability

Veripath is a dedicated user of satellite and machine learning tools for portfolio monitoring and confirmation of conservation agriculture practices. Veripath has a deep commitment to sound farm management practices and to protecting the agronomic integrity of its portfolios.

TerraFIRST

TerraFIRST is a proprietary farmland portfolio construction, monitoring and operations platform. Automated monitoring and farming practices verification tools combined with real-time satellite and AI systems to ensure accurate, scalable and cost-effective oversight. System captures and stores valuable long-term, verified data about land quality and farming practices